Hsmb Advisory Llc for Beginners

Hsmb Advisory Llc for Beginners

Blog Article

Little Known Questions About Hsmb Advisory Llc.

Table of ContentsThe Basic Principles Of Hsmb Advisory Llc Rumored Buzz on Hsmb Advisory LlcFacts About Hsmb Advisory Llc RevealedExcitement About Hsmb Advisory Llc

Life insurance policy is specifically essential if your family depends on your wage. Market specialists recommend a plan that pays 10 times your annual income. When estimating the quantity of life insurance coverage you require, element in funeral service costs. Determine your family's daily living costs. These might include mortgage settlements, outstanding financings, debt card financial debt, taxes, child treatment, and future university costs.Bureau of Labor Data, both spouses worked and brought in earnings in 48. They would be likely to experience financial challenge as an outcome of one of their wage earners' deaths., or exclusive insurance coverage you get for on your own and your family members by speaking to wellness insurance business directly or going through a health and wellness insurance policy representative.

2% of the American population was without insurance policy protection in 2021, the Centers for Disease Control (CDC) reported in its National Facility for Health And Wellness Data. Even more than 60% got their coverage via an employer or in the exclusive insurance market while the rest were covered by government-subsidized programs consisting of Medicare and Medicaid, professionals' benefits programs, and the government market developed under the Affordable Care Act.

Indicators on Hsmb Advisory Llc You Should Know

If your earnings is reduced, you might be just one of the 80 million Americans that are eligible for Medicaid. If your income is moderate yet does not stretch to insurance policy protection, you might be qualified for subsidized insurance coverage under the government Affordable Care Act. The finest and least costly choice for employed employees is typically taking part in your company's insurance coverage program if your employer has one.

According to the Social Security Management, one in four employees going into the labor force will certainly become impaired before they reach the age of retirement. While health insurance policy pays for hospitalization and medical bills, you are typically burdened with all of the expenditures that your income had covered.

Many plans pay 40% to 70% of your earnings. The cost of special needs insurance coverage is based on lots of variables, consisting of age, lifestyle, and wellness.

Several plans need a three-month waiting duration prior to the coverage kicks in, offer an optimum of 3 years' well worth of insurance coverage, and have considerable plan exemptions. Right here are your options when acquiring auto insurance policy: Obligation insurance coverage: Pays for property damage and injuries you cause to others if you're at mistake for a crash and additionally covers litigation prices and judgments or settlements if you're filed a claim against since of an automobile mishap.

Comprehensive insurance policy covers theft and damages to your auto because of floodings, hail storm, fire, criminal damage, dropping objects, and animal strikes. When you fund your cars and truck or rent a car, this kind of insurance is obligatory. Uninsured/underinsured motorist () coverage: If a without insurance or underinsured vehicle driver strikes your vehicle, this insurance coverage pays for you and your guest's clinical expenditures and might likewise represent lost income or compensate for discomfort and suffering.

Company insurance coverage is usually the most effective choice, yet if that is unavailable, obtain quotes from click here to read numerous service providers as several provide discounts if you buy even more than one kind of insurance coverage. (https://trello.com/u/hsmbadvisory)

Hsmb Advisory Llc Fundamentals Explained

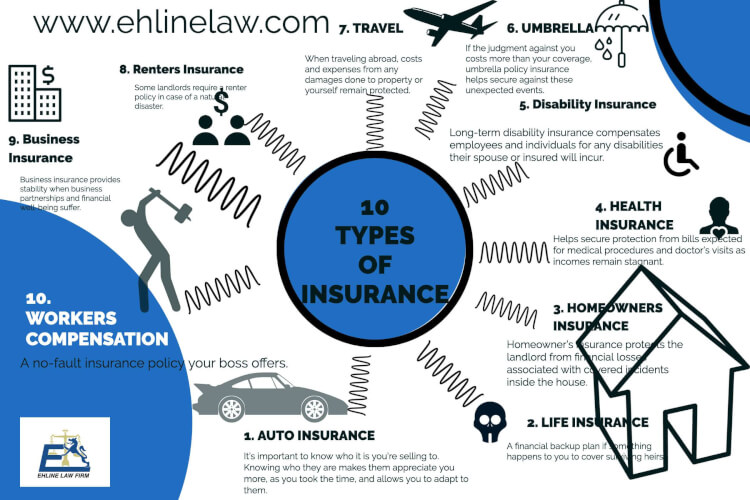

In between medical insurance, life insurance policy, impairment, obligation, long-lasting, and even laptop insurance, the task of covering yourselfand thinking of the endless possibilities of what can take place in lifecan really feel frustrating. Once you understand the fundamentals and make sure you're properly covered, insurance can improve monetary confidence and wellness. Here are one of the most crucial sorts of insurance coverage you need and what they do, plus a couple pointers to prevent overinsuring.

Different states have different laws, yet you can expect medical insurance (which many individuals obtain with their employer), car insurance policy (if you have or drive a car), and property owners insurance (if you possess building) to be on the listing (https://www.viki.com/collections/3896580l). Compulsory sorts of insurance policy can alter, so look into the current laws every so often, particularly prior to you renew your policies

Report this page